Corporate Governance

BenQ Materials has established its corporate governance structure and implementation practices in accordance with the ROC Company Law, the Securities and Exchange Act, and other relevant laws and regulations. Under the Board of Directors, there is currently an Audit Committee and a Compensation Committee, both of which are composed of all independent directors. All directors, including independent directors, are elected by shareholder vote.

Get the

Corporate governance

Passed TIPS Re-certification

Board of Directors

BenQ Materials has established its corporate governance framework and implementation practices in accordance with the Company Act, the Securities and Exchange Act, and other relevant laws and regulations of the Republic of China (Taiwan). Under the Board of Directors, two functional committees have been established: the Audit Committee and the Remuneration Committee. Both committees are composed entirely of independent directors. All directors, including independent directors, are elected by shareholders.

The Board of Directors is the highest governance body of BenQ Materials. It is primarily responsible for setting corporate strategies, supervising management, overseeing the implementation of corporate governance practices, and being accountable to the company and its shareholders. In accordance with Article 26-3, Paragraph 8 of the Securities and Exchange Act, BenQ Materials has adopted the "Rules of Procedure for Board Meetings," and all related matters are conducted accordingly. The Board convenes at least four times a year. In 2024, the Board held four meetings. For details, please refer to page 12 of the BenQ Materials Annual Report: "Corporate Governance Operations."

Composition and Nomination Process

According to the Articles of Incorporation of BenQ Materials, the election of directors (including independent directors) follows a candidate nomination system, conducted in accordance with the Company Act, the Securities and Exchange Act, and other relevant regulations. Additionally, Article 20 of the Corporate Governance Best Practice Principles stipulates that the composition of the Board of Directors shall consider diversity. Except for directors concurrently serving as managerial officers, who shall not comprise more than one-third of the board seats, appropriate diversity policies should be established based on actual operational needs and business development.

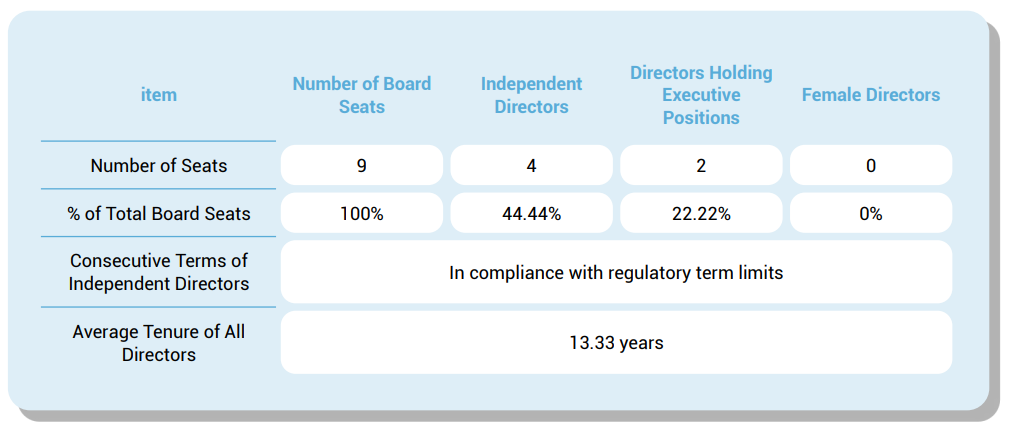

As of 2024, the Board of Directors consists of nine members, including four independent directors. All members possess over five years of relevant experience in fields such as business, law, finance, accounting, or other areas related to the company's operations.

The Chairperson of the Board also serves as the Chief Executive Officer, acting as both the highest governance authority and a member of executive management. This dual role aims to enhance operational efficiency and execution of strategic decisions. To strengthen board independence, the company actively develops internal successors. Moreover, the Chairperson maintains close communication with all board members to ensure transparent updates on business performance and strategic direction, thereby upholding sound corporate governance.

Board Diversity

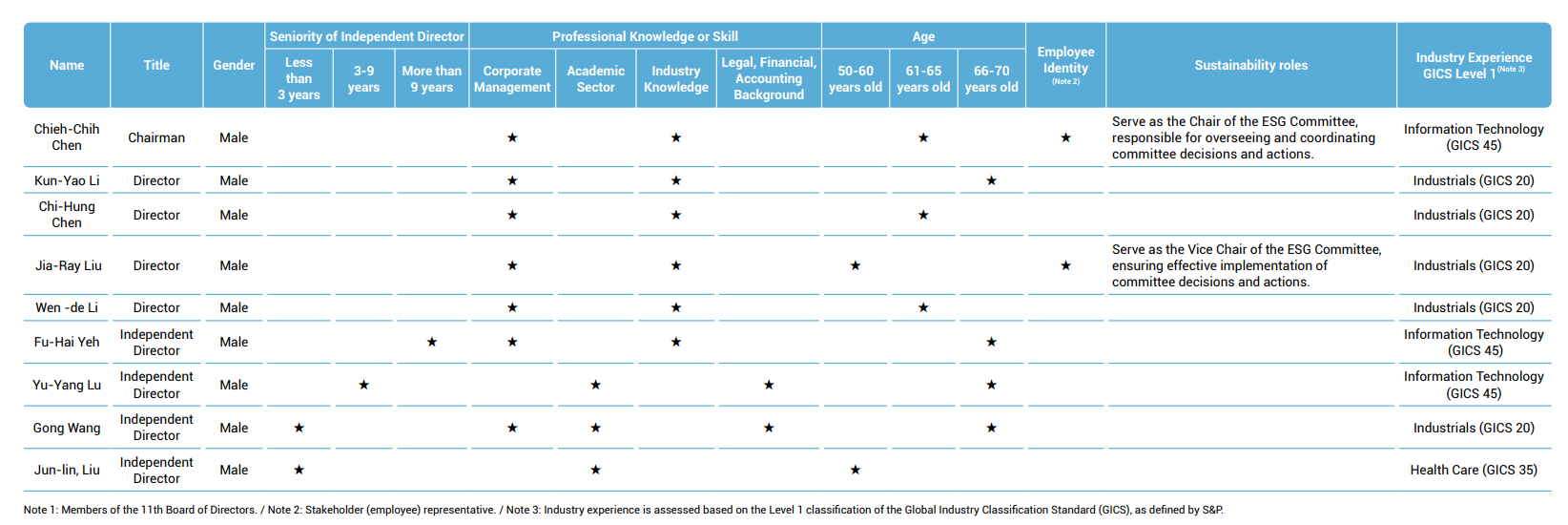

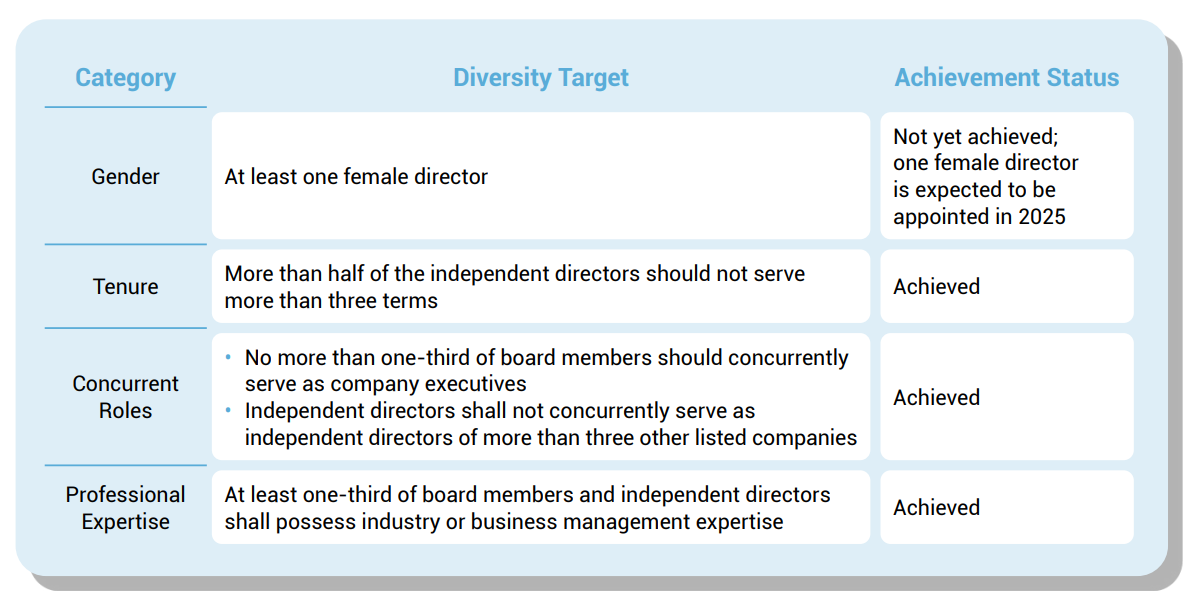

All current board members are nationals of the Republic of China (Taiwan), reflecting the Company's primary operational locations and market focus in the Asia region. While there are no foreign directors at present, several members possess extensive experience in multinational corporate management and international market operations, enabling the Board to effectively address global business needs. To further implement the Board Diversity Policy, the Company plans to appoint one female director in 2025, with the goal of enhancing board competence and strengthening its oversight function.

Board Diversity Objectives

In accordance with the ''Corporate Governance Best-Practice Principles,'' the Company has established a board diversity policy. The composition of the board considers the Company's actual operations, business model, and development needs, and adopts a diversity approach that includes gender, age, cultural background, and professional experience.

As of today, the Board comprises nine members (including four independent directors), with more than half possessing expertise in business management and relevant industry knowledge. Among the independent directors, Lu Yu-Yang, Wang Gong, and Liu Jun-Lin have extensive academic and research backgrounds, while independent director Yeh Fu-Hai is the Vice Chairman of WPG Holdings, bringing significant experience in corporate leadership and strategic decision-making.

The percentage of board members who are also employees is 22%, and independent directors account for 44%. In terms of age distribution, two directors are aged between 50 and 60, five between 61 and 70, and two are over 71. The Company has set specific targets for board diversity, as detailed in the following table.

ESG Training for the Board of Directors

BenQ Materials provides regular ESG-related training to members of the Board of Directors to strengthen their understanding of key sustainability topics and enhance their oversight capabilities. In 2024, training sessions covered areas such as sustainable supply chain management, carbon reduction strategies, business ethics, information security, and corporate governance.

Board of Directors Performance Evaluation

On May 6, 2019, the Board of Directors approved the ''Board Performance Evaluation Policy,'' which requires the Company to conduct an annual self-assessment of the Board and its members, and an external evaluation at least once every three years. The most recent self-assessment was completed at the end of 2024, and the results were reported to the Board in February 2025. The average self-assessment score of directors reached 98.9 points, and the Board achieved a 100% attendance rate in 2024, indicating sound operational performance.

Governance Executive Compensation Strategy

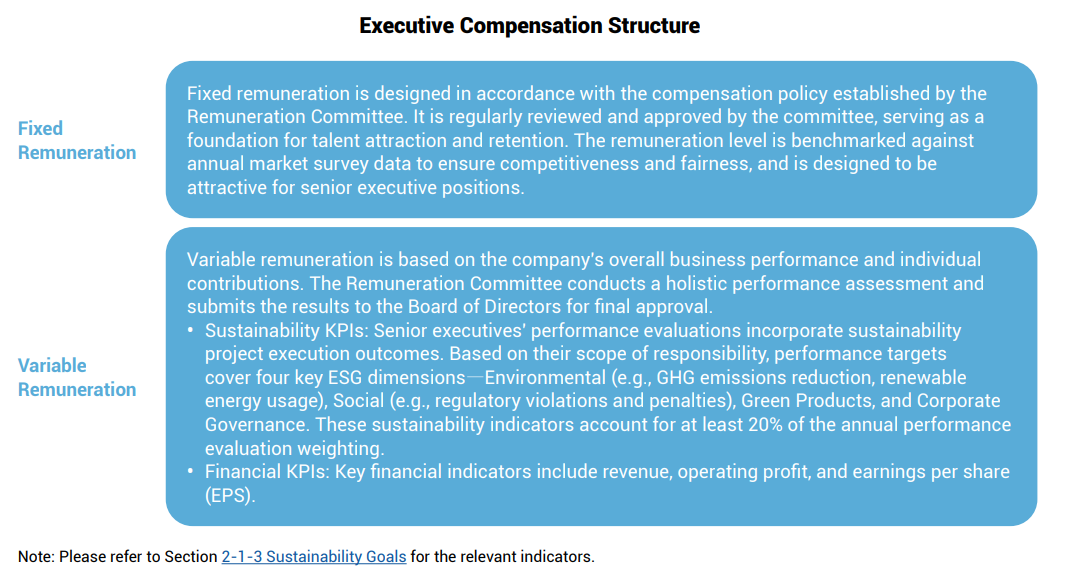

To incentivize the management team to create long-term shareholder value while attracting, retaining, and developing top talent, BenQ Materials has established an executive compensation strategy grounded in these principles. The total compensation and benefits for senior management are designed in accordance with the remuneration policies formulated and approved by the Remuneration Committee.

Executive compensation is benchmarked against annual market survey reports and determined based on the company's overall operational performance, individual performance, and contributions. To promote the implementation of corporate sustainability initiatives, the performance outcomes of sustainability-related projects—within each executive's scope of responsibility—are integrated into their annual performance goals.

These sustainability-related targets span across environmental impact reduction, social responsibility, green product development, and corporate governance. At least 20% of each executive's performance evaluation is weighted toward these four ESG dimensions, based on their managerial responsibilities.

Final performance evaluations are comprehensively reviewed by the Remuneration Committee and submitted to the Board of Directors for approval prior to determining annual bonuses or incentive payouts.

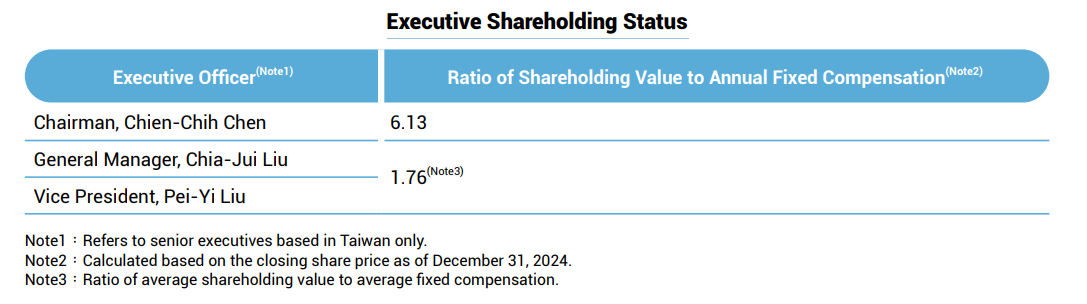

Executive Shareholding Status

Ratio of Highest Organizational Pay to Employee Pay

| Ratio of the highest total annual compensation to the average employee compensation (Note1) | Ratio of the highest total annual compensation to the median employee compensation(Note2) | Pay ratio increase of the highestpaid individual compared to the median employee pay increase(Note3) |

|---|---|---|

| 12.85 | 16.23 | -21.14 (Note4) |

Note1:Annual total compensation ratio = Total annual compensation of the highest-paid individual / Average total annual compensation of all employees (excluding the highest-paid individual) Note2:Total compensation of the highest-paid individual / Median total compensation of all full-time, non-supervisory employees Note3:(Increase in total compensation of the highest-paid individual) / (Increase in median employee compensation, excluding the highest-paid individual) Note4:The highest-paid individual received a lower total compensation compared to the previous year, while the median employee pay increased; hence, the value is negative.

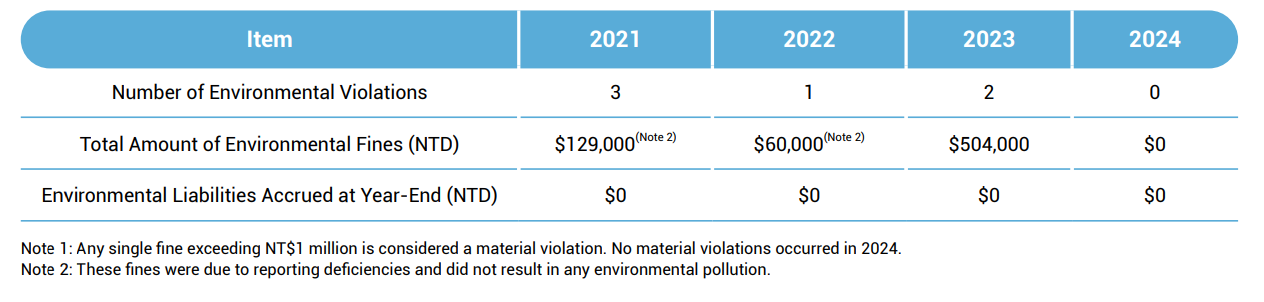

Legal and Regulatory Compliance

From 2021 to 2024, the company was not subject to any environmental or ecological administrative fines exceeding NT$300,000 (approximately USD 10,000) per case. In 2024, BenQ Materials also did not experience any major violations related to social or governance aspects, including but not limited to: labor disputes, human rights violations, major workplace safety incidents, fraud, financial misstatements, violations of related party transaction rules, or other breaches of corporate governance principles or legal requirements. Relevant information is disclosed in the company's 2024 Annual Report (p.38).

| 『Corporate Governance Principles』 | PDF. | |

| 『Operating Procedures for Handling Material Information and Preventing Insider Trading』 | PDF. | |

| 『Sustainable Development Practice Guidelines』 | PDF. |

- For more information on the operation and implementation of dedicated (or part-time) positions to promote corporate governance, corporate social responsibility, and business integrity, please visit the Investor Relations section.

- For more information related to shareholders, please visit the Shareholders' section.

- For details on company finances and annual reports, please refer to the Financial Information section.