Risk Management

In 2010, BenQ Materials established the Risk Management Committee (RMC), focusing on the risk management system and risk transfer planning in corporate governance. The committee sets out the risk management vision and policies, analyzes internal and external strategic risks, financial risks, operational risks, and hazard risks, and conducts risk identification and evaluation, improvement plans, and regular management reviews to effectively manage risks exceeding the risk tolerance. The aim is to build BenQ Materials into a resilient company capable of withstanding risks.

In 2020, the Board of Directors approved the "Risk Management Policy and Procedures." On August 8, 2022, the Taiwan Stock Exchange Corporation issued the "Practical Guidelines for Risk Management of Listed and OTC Companies" (Letter No. 1110015360), and the first Board meeting in 2023 completed the revisions and approval.

Risk Management Policy

To ensure the company's sustainable operations, a Risk Management Committee shall be established to identify, assess, manage, report, and monitor risks that may adversely impact the company's operational objectives on a regular annual basis.

• Before incidents occur, risks should be identified and controlled.

• During incidents, damage should be contained.

• After incidents, rapid recovery of product and service provision should be ensured.

For material risk scenarios identified by the Risk Management Committee, Business Continuity Plans (BCPs) and Emergency Response Manuals shall be formulated and updated regularly.

For risks that do not exceed the company's risk tolerance, cost-effectiveness of risk management should be considered and appropriate management tools applied.

However, exceptions apply in cases involving:

• Negative impacts on employee safety,

• Legal or regulatory violations,

• Reputational damage to the company.

Organizational Structure and Operation of the Risk Management Committee

Risk Management Operation

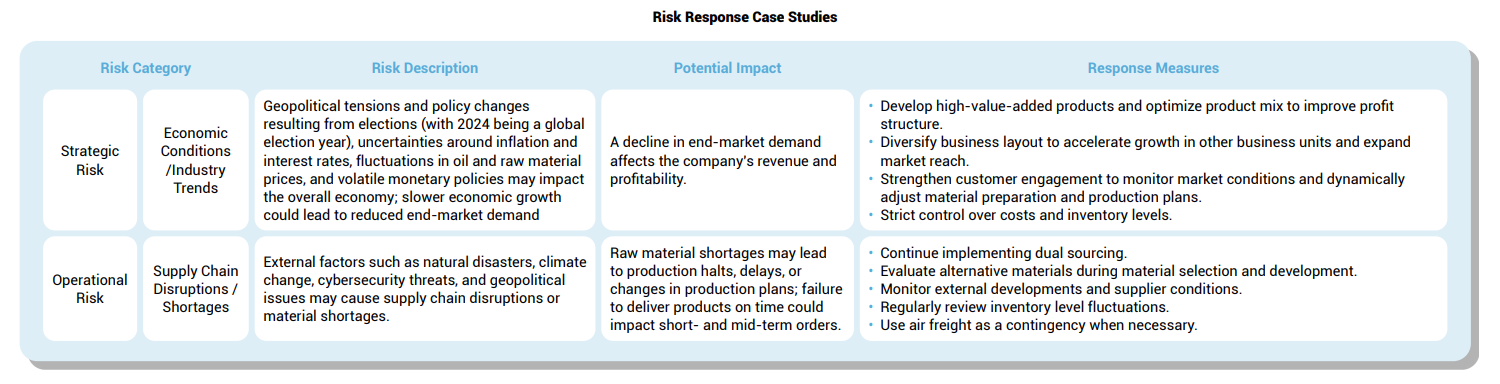

Each year, all adverse events that may affect the achievement of the company's operational objectives are categorized into four major risk types: strategic, operational, financial, and hazard risks (including consideration of emerging risks, which are classified based on their nature). A risk radar chart is developed based on risk identification, analysis, and evaluation to support risk management.

Each business unit formulates risk response measures by considering:

• The company's annual top-level risk mitigation objectives

• Results of internal unit-level risk identification and assessment

• Other events that may impact operations

Management review meetings are held semi-annually to report, discuss, monitor, and review the effectiveness of risk management implementation.

The overall operation of the risk management system is overseen by the Audit Committee and the Board of Directors, with annual reports delivered to both bodies on a regular basis.

In 2024, two risk management review meetings were held, during which a total of 27 risk mitigation plans were managed. Nearly 40% of these were mid- to long-term plans that will continue into 2025.

Additionally, in response to climate change risks, the company has followed the Task Force on Climaterelated Financial Disclosures (TCFD) framework to identify and assess risks and opportunities, and has formulated response plans for major risks. A total of 24 adaptation action plans have been developed for the short, medium, and long term. (For details, see Section 5-2-2 Climate Change Management Strategy and Actions.) The report was presented to the Audit Committee and the Board of Directors on October 31, 2024.

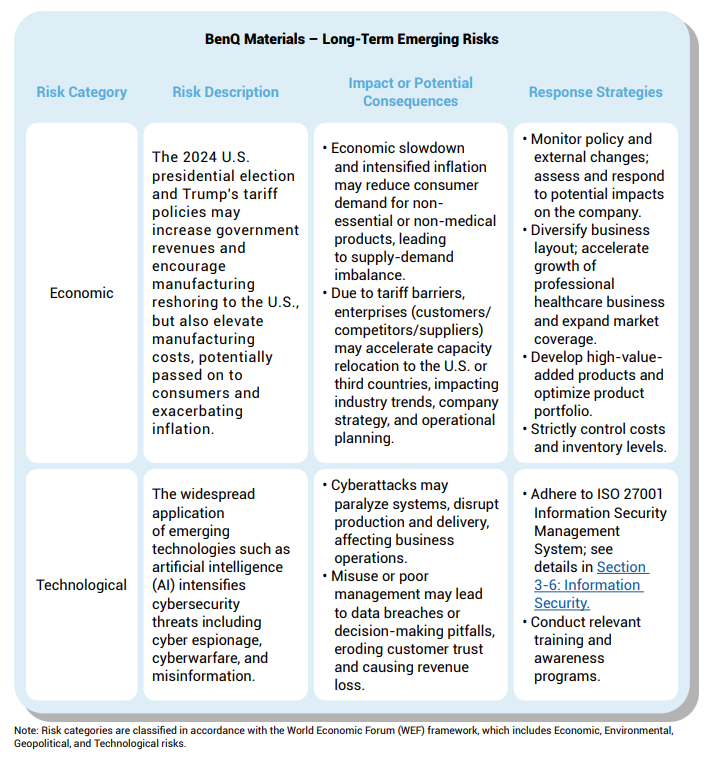

Emerging Risk Response

In response to the constantly evolving global landscape, BenQ Materials has identified long-term emerging risks based on the World Economic Forum (WEF) risk categories, focusing on two key dimensions: economic and technological. For each identified risk, the company outlines the potential impact and proposes concrete response strategies to strengthen its sustainability performance and risk management capabilities.